What Is a Drug Formulary? A Simple Guide for Patients on Costs, Tiers, and How to Navigate Coverage

Jan, 8 2026

Jan, 8 2026

A drug formulary is a list of prescription medications that your health insurance plan agrees to cover - either fully or partially. It’s not just a catalog; it’s a tool that decides what drugs you can get at a low cost, and which ones might leave you paying hundreds or even thousands out of pocket. If you’ve ever been surprised by a high copay for a medication you thought was covered, you’ve run into the real-world impact of a formulary.

How Drug Formularies Work

Every formulary is built by your insurance company or Pharmacy Benefit Manager (PBM) - the middlemen who negotiate drug prices on behalf of insurers. They don’t pick drugs randomly. A team of doctors, pharmacists, and researchers - called a Pharmacy and Therapeutics (P&T) committee - reviews clinical data, safety records, and cost-effectiveness to decide which medications make the list.

The goal? To give you access to safe, effective drugs while keeping overall costs down. But here’s the catch: not all drugs are treated the same. That’s where tiers come in.

The Tier System: What You Pay Depends on the Level

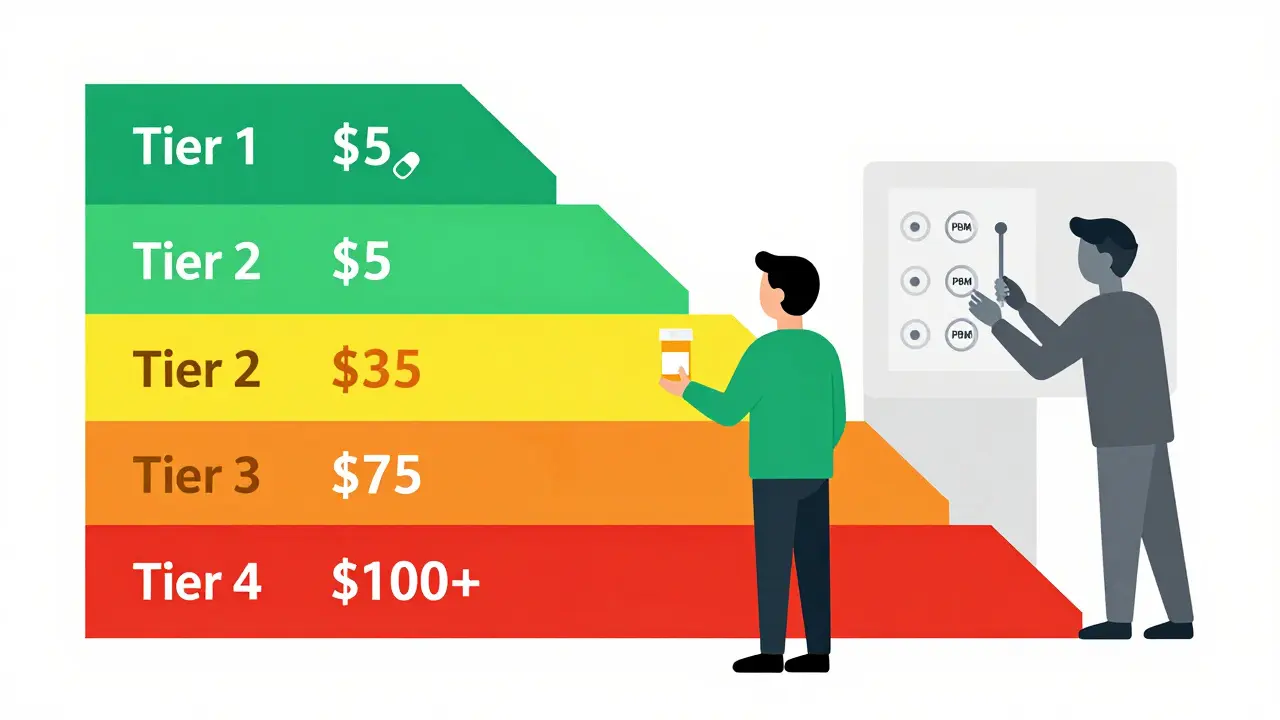

Most formularies use a tier system - usually 3 to 5 levels - that directly affects how much you pay at the pharmacy. The higher the tier, the more you pay.

- Tier 1: Generic Drugs - These are the cheapest. They contain the same active ingredients as brand-name drugs but cost a fraction. Most plans charge $0 to $10 for a 30-day supply. If your doctor prescribes a generic, you’re likely in the best spot.

- Tier 2: Preferred Brand-Name Drugs - These are brand-name medications the plan has negotiated lower prices for. You might pay $25 to $50 per prescription, or 15-25% coinsurance. This tier often includes common drugs for high blood pressure, diabetes, or cholesterol.

- Tier 3: Non-Preferred Brand-Name Drugs - These are brand-name drugs that cost more and aren’t the plan’s top pick. Expect $50 to $100 per fill, or 25-35% coinsurance. If your medication is here, ask your doctor if a Tier 2 alternative exists.

- Tier 4: Specialty Drugs - These are high-cost medications for complex conditions like cancer, rheumatoid arthritis, or multiple sclerosis. Copays can start at $100 and go up. Coinsurance often hits 30-50%. Some plans even have a Tier 5 for the most expensive drugs, like gene therapies.

For example, a diabetes medication like metformin (a generic) might cost $5. But if your plan puts a similar brand-name drug like Glucophage XR in Tier 3, you could pay $75 instead. That’s why checking your formulary before filling a prescription matters.

Why the Same Drug Costs Different Amounts

Two people on different insurance plans can get the same prescription - and pay completely different prices. Why? Because each plan builds its own formulary.

A 2022 Kaiser Family Foundation study found that identical medications could cost anywhere from $15 to $150 per month depending on the plan. One insurer might list a popular cholesterol drug as Tier 2. Another might put it in Tier 3 - no change in the drug, just a change in how the plan values it.

Even the names of tiers vary. One plan calls them “Preferred Generic,” “Preferred Brand,” and “Specialty.” Another uses numbers. Some don’t show tiers at all - they just list drugs as “covered,” “covered with restrictions,” or “not covered.”

What Happens When Your Drug Isn’t on the List?

If your doctor prescribes a drug that’s not on your plan’s formulary, it’s called “non-formulary.” That usually means one of two things: you pay full price - sometimes hundreds of dollars - or your plan won’t cover it at all.

But you’re not stuck. You can ask for a formulary exception. This is a formal request - usually started by your doctor - asking the plan to cover the drug anyway. The request must include medical reasons: maybe you tried the formulary alternatives and had bad side effects, or the other drugs simply don’t work for your condition.

In 2023, 67% of Medicare Part D formulary exception requests were approved, according to the Medicare Payment Advisory Commission. Urgent cases - like a life-threatening condition - can be reviewed in 24 hours. Standard requests take about 72 hours.

Restrictions That Can Block Your Prescription

Even if your drug is on the formulary, your plan might still put limits on it. These are called utilization management tools:

- Step Therapy - You must try one or two cheaper drugs first. Only if they fail can you get the one your doctor originally prescribed. For example, your doctor might want to start you on a new rheumatoid arthritis drug, but the plan requires you to try methotrexate first.

- Prior Authorization - Your doctor must get approval from the plan before the pharmacy can fill the prescription. This often happens with expensive or high-risk drugs. The plan may ask for lab results, diagnosis codes, or proof that other treatments didn’t work.

- Quantity Limits - You can only get a certain amount at a time. For example, your pain medication might be limited to a 30-day supply, even if your doctor wrote a 90-day prescription.

These rules can be frustrating. A 2023 survey by the Commonwealth Fund found that 31% of patients had a prescription denied or delayed because of one of these restrictions. But they’re meant to prevent overuse and encourage cost-effective care.

How to Check Your Formulary

You don’t have to guess what’s covered. Every health plan - including Medicare Part D - must make its full formulary available online. Look for a link labeled “Drug List,” “Formulary,” or “Preferred Drug List” on your insurer’s website.

For Medicare beneficiaries, the Medicare Plan Finder tool (updated every October for the next year’s coverage) lets you enter your medications and compare how different plans cover them. It’s free, easy to use, and updated by the government.

Check your formulary every year during open enrollment (October 15 to December 7 for Medicare). Drugs can move tiers, be removed entirely, or have new restrictions added. A 2024 report from the Patient Advocate Foundation found that 28% of formulary changes happen outside the annual enrollment period.

Real Stories: What Patients Experience

One Reddit user, “MedicareMom2023,” shared how her diabetes drug jumped from Tier 2 to Tier 3 - her monthly cost went from $35 to $85. She switched to a generic alternative because she couldn’t afford the increase.

On the flip side, “CancerSurvivor87” wrote on Facebook: “My immunotherapy was on Tier 4, but my copay was $95. Without coverage, it would’ve cost $5,000. It saved my life - financially and physically.”

A 2024 GoodRx survey found that 68% of insured adults check their formulary before filling a prescription. And 42% have switched medications because of formulary changes.

What’s Changing in 2025

New rules are making formularies more patient-friendly:

- Insulin cap - Since 2023, Medicare Part D plans cap insulin at $35 per month. That’s a big win for diabetics.

- Out-of-pocket cap - Starting in 2025, Medicare will cap total annual drug spending at $2,000. After that, you pay nothing for covered drugs.

- Biosimilars - These are cheaper versions of biologic drugs. More are being approved - 43 as of mid-2024 - and formularies are adding them to lower costs.

- AI-driven formularies - By 2027, some insurers will use artificial intelligence to recommend drugs based on your medical history, not just cost.

What You Can Do

Don’t wait until you’re at the pharmacy counter. Take control:

- Find your plan’s formulary online - now, not later.

- Search for every medication you take. Note the tier and any restrictions.

- Ask your doctor: “Is there a lower-tier alternative?” or “Can we try a generic?”

- If a drug isn’t covered, ask your doctor to file a formulary exception.

- Review your formulary every year during open enrollment - even if you’re happy with your plan.

Drug formularies aren’t perfect. They can be confusing, restrictive, and sometimes feel impersonal. But they’re also the reason millions of Americans can afford life-saving medications. Understanding how they work gives you power - not just to pay less, but to get the right treatment.

What does it mean if a drug is non-formulary?

A non-formulary drug is not included on your insurance plan’s approved list. That usually means your plan won’t cover it - or will charge you full price, which can be hundreds or thousands of dollars per prescription. You can ask for a formulary exception if your doctor says the drug is medically necessary.

Can my insurance change my formulary during the year?

Yes. While most formularies are updated once a year in January, plans can make changes mid-year. They must give you at least 60 days’ notice if they remove a drug or add restrictions. If your drug is affected, you can request a temporary refill or file for a formulary exception.

Why do some generic drugs cost more than others?

Even though all generics have the same active ingredient, different manufacturers sell them. Insurance plans negotiate prices with each manufacturer. One generic might be in Tier 1 ($5), while another - identical in effect - is in Tier 2 ($25) because the plan didn’t get a good deal on it. Always check the brand name on your prescription label.

Does Medicare Part D have the same formulary everywhere?

No. Each Medicare Part D plan - offered by private insurers - creates its own formulary. While all plans must cover at least two drugs in each major category, the specific drugs, tiers, and restrictions vary widely. That’s why comparing plans during open enrollment is so important.

What’s the difference between a formulary and a drug list?

They’re the same thing. “Formulary” is the technical term used by insurers and regulators. “Drug list” or “Preferred Drug List (PDL)” are simpler terms used in patient materials. Both refer to the official list of covered medications and their cost-sharing rules.

Final Thoughts

Drug formularies are complex, but they don’t have to be confusing. The key is knowing your plan’s rules before you need them. Check your formulary regularly. Ask questions. Push back when necessary. And remember: you have rights - including the right to appeal a coverage decision. Understanding your formulary isn’t just about saving money. It’s about making sure you get the treatment you need, without surprises.

Ted Conerly

January 8, 2026 AT 19:44Formularies are a mess but knowing the tiers saves you serious cash. I used to just grab whatever my doctor prescribed until I found out my insulin was moved to Tier 3 - cost jumped from $15 to $80. Switched to a generic and saved $700 a year. Check your formulary before you fill anything. It’s not rocket science, just common sense.

Faith Edwards

January 10, 2026 AT 07:25One is left to wonder whether the modern pharmaceutical-industrial complex has morphed into a grotesque ballet of bureaucratic obfuscation, wherein the very mechanisms designed to ensure equitable access are, in fact, engineered to extract maximal profit under the veneer of fiscal prudence. The tier system is not merely a cost-control tool - it is a moral indictment of a system that values balance sheets over biological necessity.

Jay Amparo

January 10, 2026 AT 11:25From India, I’ve seen how formularies work differently here - generics are everywhere and cheap, but sometimes the quality varies. Still, I’m glad your system at least has tiers and exceptions. Many places don’t even have that. Your guide is clear and useful. I’ll share this with my cousin who’s on insulin - she’s been struggling with costs. Thanks for breaking it down without the jargon.

Lisa Cozad

January 11, 2026 AT 14:27I work in a pharmacy and see this every day. People come in confused, angry, sometimes in tears because their med isn’t covered. The worst part? They had no idea until they got to the counter. This post should be mandatory reading before anyone signs up for insurance. Seriously, take 10 minutes and look up your drugs. It’s the most important thing you’ll do for your health this year.

Saumya Roy Chaudhuri

January 11, 2026 AT 17:20You people are missing the point entirely. Formularies aren’t the problem - your doctors are. If you’re not asking for generics or biosimilars first, you’re just letting the system exploit you. I’ve been on Medicare for 12 years and I’ve never paid more than $15 for anything because I always ask for alternatives. Stop blaming the formulary. Start asking questions.

Ian Cheung

January 12, 2026 AT 03:10Just found out my cancer med moved from Tier 2 to Tier 4 last month. Copay went from $45 to $210. Called my doc and he filed an exception - got approved in 48 hours. They don’t always say no. And yeah the system sucks but you’ve got rights. Don’t just accept it. Push back. It’s not just about money - it’s about staying alive. Also 2025’s $2k cap is gonna be a game changer. Finally some good news.

anthony martinez

January 12, 2026 AT 19:16Oh wow a 10-page essay on how insurance companies make you pay more. Who knew? I thought the whole point of insurance was to not have to think about this stuff. Guess I was wrong. Next time I need my blood pressure meds I’ll just pay cash and skip the drama. Seriously though - why do we still pretend this is healthcare and not a casino?

Mario Bros

January 13, 2026 AT 17:23Bro this is the most useful thing I’ve read all year. Just saved me $90/month on my antidepressant by switching to the generic. I didn’t even know my plan had one. Thanks for the heads up - now I’m checking every med I take. Also, your last line? ‘Understanding your formulary isn’t just about saving money. It’s about making sure you get the treatment you need.’ That’s the truth. 👊