Future of Global Generic Markets: Key Trends and Predictions for 2025-2030

Jan, 21 2026

Jan, 21 2026

The global generic drug market isn’t just about cheap pills. It’s the backbone of affordable healthcare for billions. By 2028, it’s expected to hit nearly $656 billion - that’s more than half the size of the entire U.S. healthcare system. But behind those numbers is a quiet revolution: how generics are changing who gets treated, where drugs are made, and who controls the supply chain.

Why generics matter more than ever

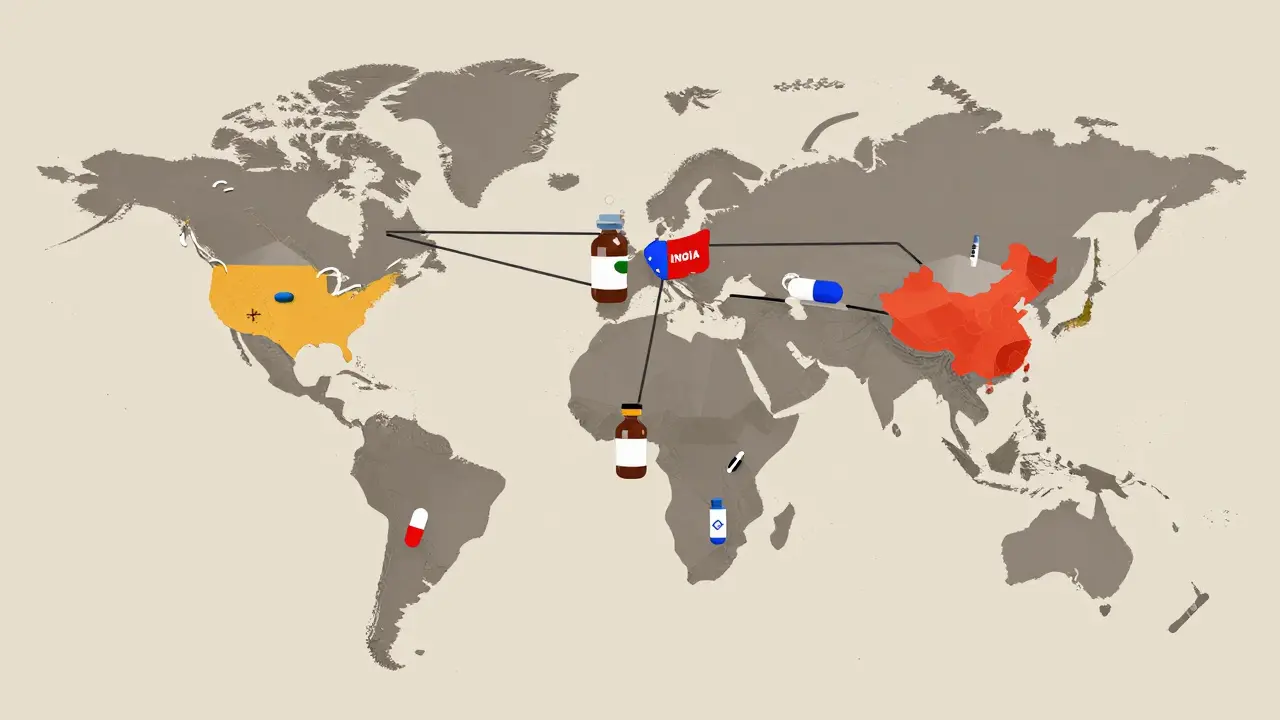

Generic drugs work exactly like brand-name ones. Same active ingredient. Same dosage. Same effect. But they cost 80-85% less. That’s not a marketing trick. It’s science. When a patent expires, other manufacturers can copy the formula. No need to spend billions on clinical trials. Just prove it’s the same. That’s why 90% of prescriptions in the U.S. are filled with generics - yet they make up only 23% of total drug spending. In countries like India and China, generics aren’t optional. They’re essential. India produces over 60,000 generic medicines and supplies 20% of the world’s volume by quantity. China makes 40% of the world’s active pharmaceutical ingredients (APIs), the raw building blocks of drugs. Without these two countries, the global supply of affordable medicine would collapse. As chronic diseases like diabetes, heart disease, and cancer keep rising - affecting 41% of the global population - governments can’t afford to pay full price for brand drugs. Generics keep people alive and systems from breaking.The biosimilar shift: generics are getting more complex

The old model of copying small-molecule pills is slowing down. The next wave is biosimilars - copies of biologic drugs, like insulin, rheumatoid arthritis treatments, and cancer therapies. These aren’t pills. They’re complex proteins made from living cells. Think of it like copying a Ferrari engine versus copying a bicycle. Producing a biosimilar takes 10-20 times more steps than a regular generic. Development costs? $100 million to $250 million. Compare that to $1-5 million for a standard generic. That’s why only big players can enter this space. But the payoff is bigger too. Biosimilars don’t slash prices by 80%. They’re priced 15-30% below the original. Still, that’s billions in savings for healthcare systems. Mordor Intelligence predicts biosimilars will grow at 12.3% annually through 2030 - the fastest-growing segment in generics. Companies that stuck to simple pills are now scrambling to build biotech labs. Those who don’t adapt will get left behind.Where the growth is: the pharmerging markets

North America and Western Europe aren’t growing fast anymore. Price controls, tight regulations, and saturated markets mean growth is stuck at 2-5% per year. The real action is in the pharmerging markets: India, China, Brazil, Turkey, Saudi Arabia, Egypt, and others. These countries aren’t just buying generics - they’re making them. India’s government poured $1.34 billion into its Production Linked Incentive (PLI) scheme in 2024 to boost domestic manufacturing. Saudi Arabia’s Vision 2030 is building local pharma hubs. Egypt now requires 50% of essential medicines to be made locally by 2025. These policies aren’t just about self-sufficiency. They’re about control. For years, the West relied on Asia for cheap drugs. Now, countries are building their own supply chains to avoid shortages, like the ones seen during the pandemic. By 2025, these emerging markets will add $140 billion in new drug spending. That’s more than the entire generic market in Europe. And it’s not just about volume. It’s about quality. Countries like Saudi Arabia and the UAE are tightening regulations to match Western standards - not to block imports, but to earn trust.

The supply chain problem: China’s dominance and the risks

Here’s the uncomfortable truth: 65% of the world’s active pharmaceutical ingredients (APIs) come from China. That’s not a choice. It’s a consequence of cost, scale, and decades of investment. But it’s also a vulnerability. When China shuts down for a holiday, or a factory gets shut by regulators, drug shortages ripple across the globe. The FDA issued 187 warning letters to foreign generic manufacturers in 2023 - 40% of them tied to quality issues at Chinese or Indian plants. It’s not that these companies are bad. It’s that the pressure to cut costs leads to corners being cut. Countries are waking up. The U.S. and EU are pushing for more API production at home. India is investing heavily. The EU is offering subsidies. But replacing China’s scale won’t happen overnight. The real goal isn’t to eliminate Chinese manufacturing - it’s to diversify it.Regulation: the silent gatekeeper

There are 78 different regulatory systems for drugs around the world. That’s a nightmare for manufacturers trying to sell globally. A drug approved in India might need another 18 months and $20 million to get approved in Brazil or Nigeria. That’s where the International Council for Harmonisation (ICH) comes in. Since 2020, 15 more countries have adopted ICH guidelines. That means fewer duplicate tests. Faster approvals. Lower costs. It’s the quiet engine making global generics possible. But harmonization isn’t universal. In places like Nigeria or Pakistan, weak oversight still allows substandard drugs to flood markets. The FDA and WHO are pushing for better inspections. But without local enforcement, it’s a game of whack-a-mole.

The future isn’t just cheaper - it’s smarter

The old generic business model was simple: make a lot, sell cheap, hope you don’t get sued. That’s fading. The winners in 2030 won’t just be the cheapest. They’ll be the most agile. Some are building direct relationships with hospitals and insurers, cutting out middlemen. Others are bundling generics with digital tools - like apps that remind patients to take their pills or track side effects. One Indian company now offers a diabetes generic + free glucose monitoring kit. That’s not just a drug. It’s a care package. Big players are partnering with local firms. In 2024 alone, there were 37 major collaborations announced between multinational pharma companies and regional manufacturers. It’s no longer about dominating markets. It’s about embedding in them.What’s at risk? And what’s next?

The biggest threat isn’t competition. It’s complacency. If generic makers keep thinking like commodity suppliers, they’ll lose to specialty drugs - like GLP-1 weight-loss medications - that are growing at 20% a year. Generics can’t compete on innovation. But they can compete on access. By 2030, generics will still make up about 53% of prescriptions. But their share of total drug spending will drop. Why? Because the most expensive drugs - biologics, gene therapies, personalized medicines - are taking up more of the budget. Generics will remain the workhorse. But they won’t be the headline anymore. The real opportunity? Making sure those workhorses reach everyone. In rural Kenya, a $2 generic blood pressure pill saves lives. In rural Ohio, it keeps someone out of the ER. The future of generics isn’t about who makes the most profit. It’s about who keeps the system running.What to watch in the next five years

- Biosimilar adoption: Will insurance companies start covering them as first-line treatment? If yes, growth explodes.

- API diversification: Are new manufacturing hubs rising in Vietnam, Poland, or Mexico? Watch for government subsidies.

- Regulatory alignment: More countries joining ICH means faster global access.

- Price pressure: As margins shrink to 12%, only companies with scale or specialization survive.

- Digital integration: Generics paired with apps, AI monitoring, or telehealth could become the new standard.

The global generic market isn’t dying. It’s evolving. The players who survive won’t be the biggest. They’ll be the ones who understand that medicine isn’t just chemistry. It’s access. It’s trust. And it’s dignity.

Are generic drugs as safe as brand-name drugs?

Yes. By law, generic drugs must contain the same active ingredient, strength, dosage form, and route of administration as the brand-name version. They’re tested to prove they work the same way in the body. The FDA requires generics to meet the same strict quality standards as brand drugs. The main difference is price - not safety or effectiveness.

Why are biosimilars more expensive to make than regular generics?

Biosimilars are copies of biologic drugs, which are made from living cells - not chemicals. That means the manufacturing process is far more complex. It involves growing cells in controlled environments, purifying proteins, and ensuring every batch is identical. A regular generic might need 5-10 steps. A biosimilar needs 100-200. That’s why development costs are 20-100 times higher.

Which countries dominate generic drug manufacturing?

India and China are the leaders. India produces over 60,000 generic medicines and supplies 20% of the world’s volume by quantity. China makes about 40% of global active pharmaceutical ingredients (APIs) and 65% of the world’s raw materials for generics. Together, they control roughly 35% of global manufacturing capacity.

Why do some countries have low generic usage despite low prices?

It’s often about policy and perception. In Italy and parts of Latin America, doctors and patients still prefer brand names due to tradition, marketing, or lack of trust in local manufacturers. Reimbursement rules also play a role - if insurance pays the same for a brand or generic, there’s no incentive to switch. Changing that takes education, regulation, and time.

Will generics still be relevant if specialty drugs keep growing?

Absolutely. Specialty drugs - like cancer treatments or GLP-1 weight-loss drugs - are expensive and often used by a small group. Generics treat the majority: high blood pressure, diabetes, cholesterol, infections. They’re the foundation. Even as specialty drugs grow, generics will still fill 9 out of 10 prescriptions. They’re not going away - they’re just becoming the quiet backbone of global health.

Oladeji Omobolaji

January 21, 2026 AT 20:48Man, I just saw a guy in Lagos buy his blood pressure meds for $1.50 instead of $80 back home. Generics aren't just smart-they're survival. No hype, just facts.

Janet King

January 22, 2026 AT 11:46The data presented is accurate and aligns with FDA and WHO reports on generic drug utilization. The cost savings are well documented and represent a critical public health advancement. Regulatory harmonization through ICH remains essential to global access.

Laura Rice

January 22, 2026 AT 22:55This is the quiet hero story no one talks about. A $2 pill in Kenya keeps a mother alive. A $5 diabetes kit in Ohio keeps a dad from the ER. This isn't just pharma-it's dignity. And we're letting it slip away because we're too busy chasing the next miracle drug. We need to wake up.

Stacy Thomes

January 23, 2026 AT 01:45YES! This is it! Generics are the unsung champions of healthcare! We need to celebrate them like heroes-not just tolerate them! Imagine if every kid in every village had access to this. This is the future we can build-right now!

Dawson Taylor

January 23, 2026 AT 19:32The shift from commodity to capability is inevitable. Scale without adaptability is obsolescence.

Andrew Smirnykh

January 24, 2026 AT 23:10India’s PLI scheme and Saudi Vision 2030 are more than policy-they’re sovereignty moves. The West assumed global supply chains were permanent. They weren’t. This is a geopolitical reset in slow motion.

Kerry Evans

January 26, 2026 AT 05:15China controls 65% of APIs? That’s not a supply chain-it’s a hostage situation. And the FDA’s 187 warning letters? That’s not negligence. That’s systemic failure. We let this happen because we were too lazy to build our own. Now we pay the price.

Sue Stone

January 26, 2026 AT 21:38My grandma takes her generic statin every day. She’s 82. Still walks the dog. No drama. Just pills. The system works-when we let it.